- Dozent/in: Hans Jürgen Schmitz

- Dozent/in: Holger Techen

- Dozent/in: Tatjana Vautz

Kursbereich: Master-Studiengänge

Wir machen Urlaub!

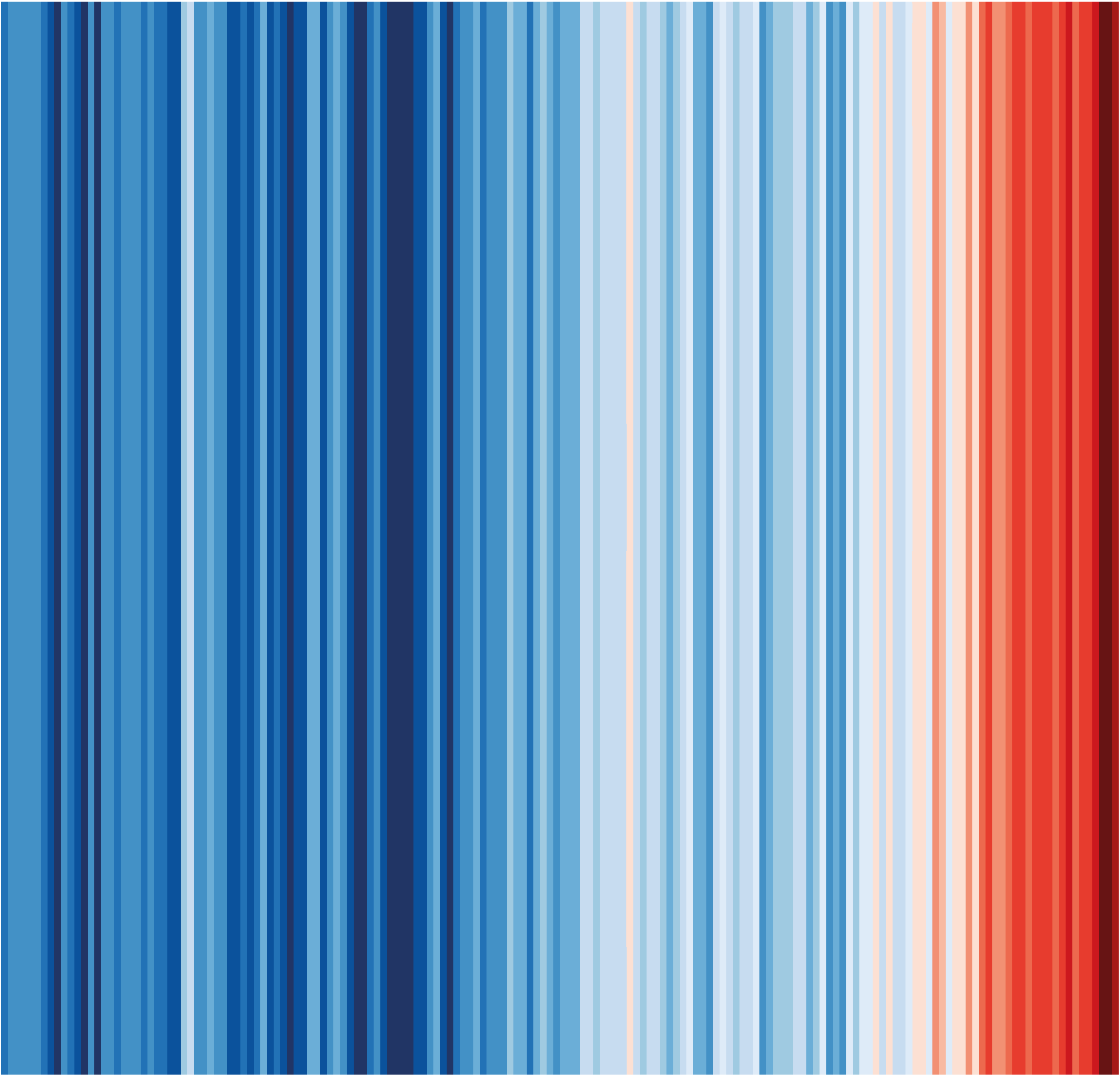

Das Ziel der Projektbearbeitung ist die Konzeption eines autarken Wochenendhauses

auf der Ile Crezic, departement Morbihan, in Frankreich. Die günstigen klimatischen

Bedingungen sollen genutzt werden, um mit rein baulichen und passiven

Maßnahmen ein Gebäude zu entwickeln, dass an möglichst vielen Tagen im Jahr

komfortable Aufenthaltsbedingungen ermöglicht.

Dies ist der Kurs für Nachholer TA1, die TA2 bereits belegt/abgeschlossen haben. Der Kurs findet nach noch aktueller PO letztmalig statt.